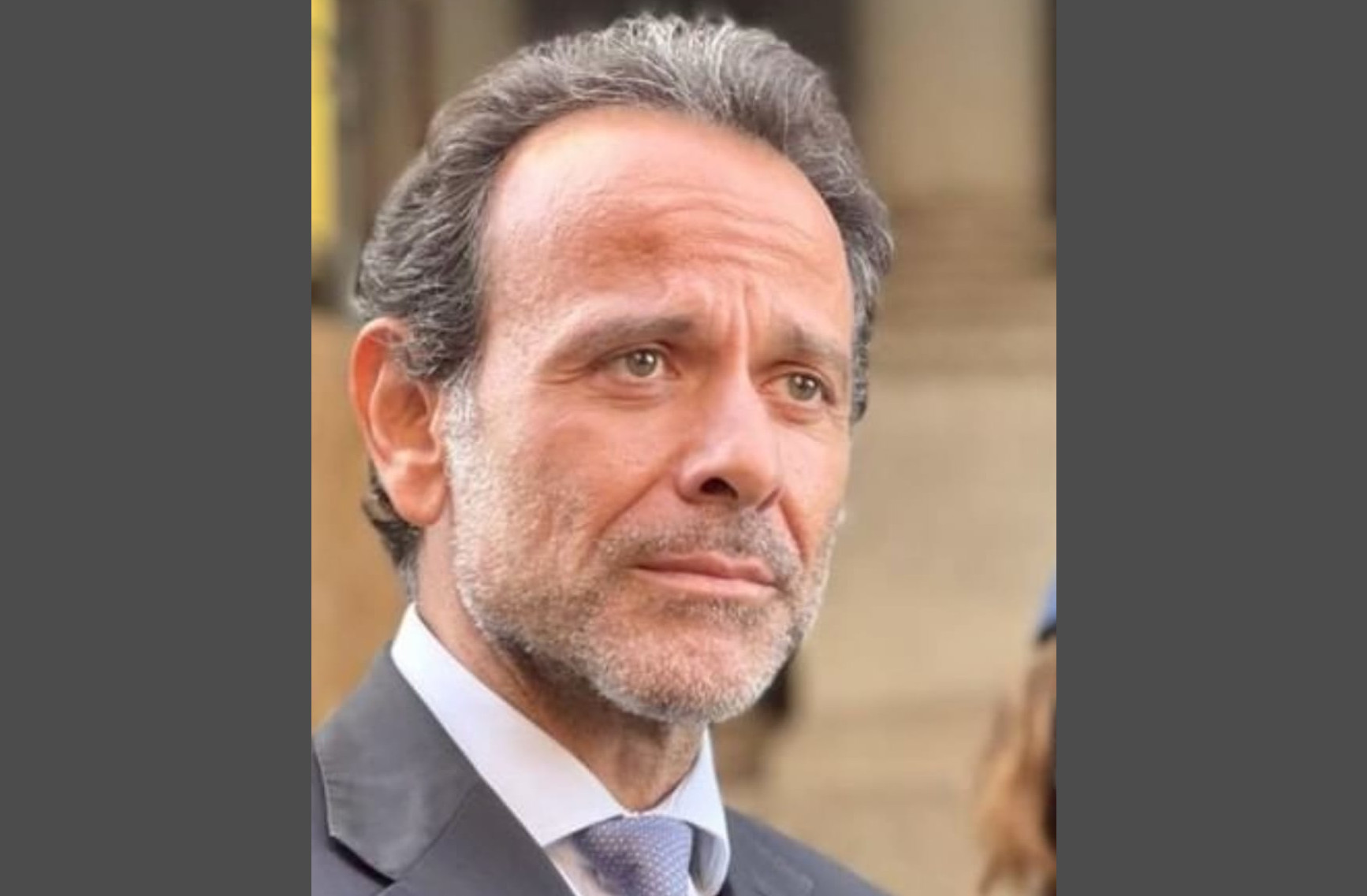

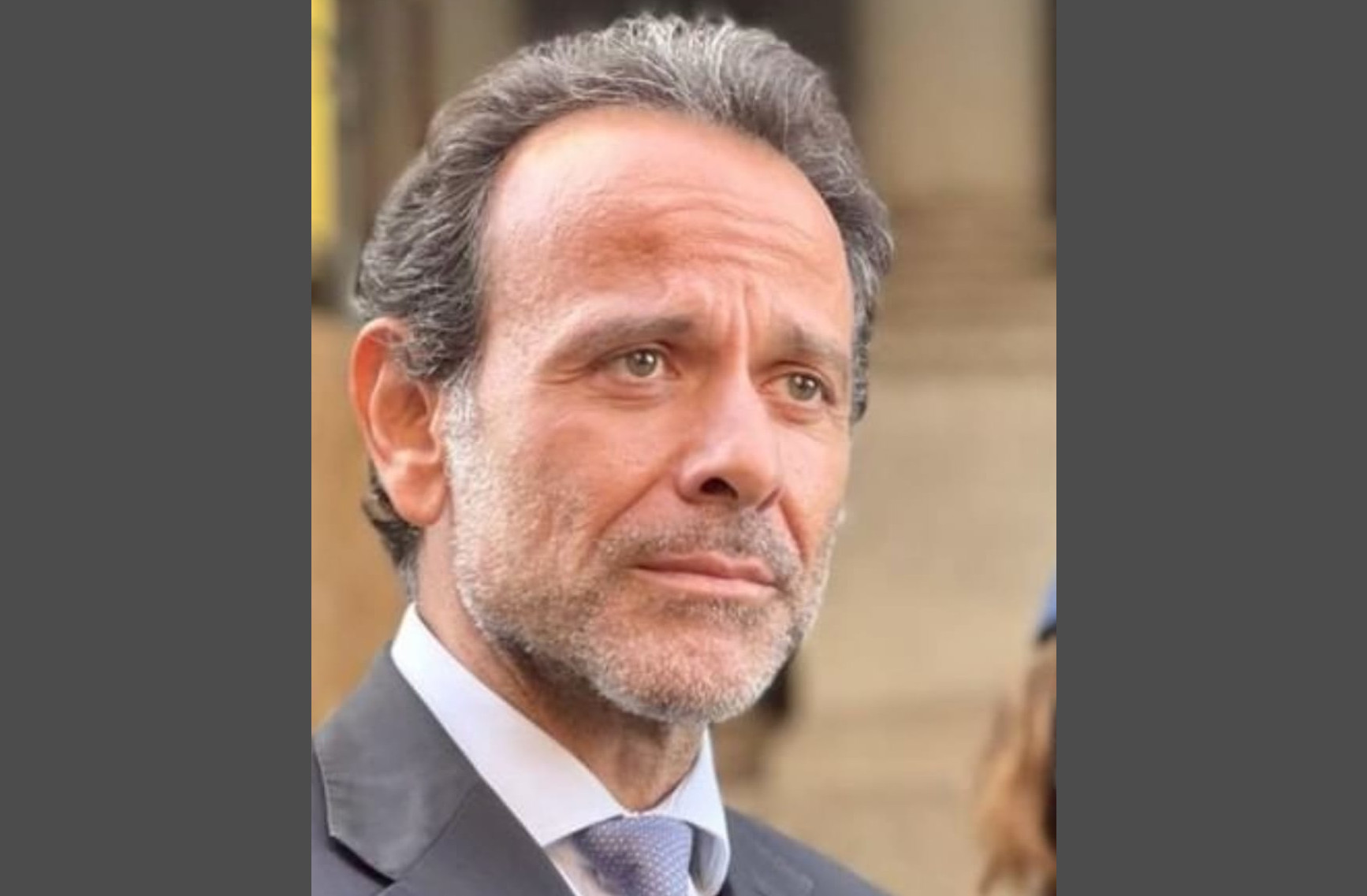

Marcello Minenna (Bari, December the 26th, 1971) is a civil servant and economist expert in Stochastic Finance.

Currently he is Technical Assessor of the Calabria Region, for Economy and Finance, Strategic Planning and Guidelines for the implementation of actions financed by National and Community Funds and a member of the National Conference for the Coordination of Port Authorities for the Italian Ministry of Infrastructure and Transport.

He is an Adjunct Professor of ESG and Sustainable Finance at the LUISS University of Rome and of Asset Pricing at La Sapienza University of Rome.

He is a professional journalist and writes as a Columnist for Il Sole 24 Ore, the Financial Times, Risk Magazine and Central Banking.

He was General Director of the Excise, Customs and State Monopolies Agency. Previously: Technical Assessor for Budget, Municipal Assets, Social Policies, and Spending Review of Roma Capitale; chair of the CEMA MiFID2 Task Force at ESMA; head of the Quantitative Analysis and Financial Innovation Unit at Consob.

He was Columnist of Corriere della Sera, La Repubblica and of The Wall Street Journal.

Author of over 100 publications, including:

- The Incomplete Currency, bestselling book in 2016, published by Wiley & Son (2016) with a foreword by Romano Prodi, where he analyses the Eurozone architecture and highlights its critical features and the possible solutions thereto;

- A Quantitative Framework to Assess the Risk-Return Profile of Non-Equity Products, published by Riskbooks (2009), where he illustrates a set of probability indicators in order to measure financial products’ risks based on the Fundamental Theorem of Asset Pricing;

- A Guide to Quantitative Finance, published by Riskbooks (2006), a basic scientific text on stochastic finance. It was a bestseller in 2006.

- Target 2 determinants: The role of Balance of Payments imbalances in the long run. Journal of Banking & Finance, (2021).

- Making the Eurozone works: a risk-sharing reform of the European Stability Mechanism, Annals of Operations Research, (2019).

- A revisited and stable Fourier transform method for affine jump diffusion models. Journal of Banking & Finance, (2008).

- The challenges for the post-pandemic Chinese economy. Law and economics Yearly Review, vol. 10, part. 2, (2021).

- Target2 determinants: The Role of Balance of Payments imbalances in the long run. Journal of Banking & Finance, (2021).

- A look at EU-UK Trade Relations in light of Brexit, Pandemic, and the Trade and Cooperation Agreement. Law and Economics Yearly Review, Vol. 9, part. 2, (2021).

- A market-based analysis of Italy’s redenomination risk: between EMU limits and Eurosceptic sentiments. Law and Economics Yearly Review, Vol. 9, Part 1 Supplement, (2020).

- The New Eurozone Risk Morphology. Open Review of Management, Banking and Finance, (2020).

- Making the Eurozone works: a risk-sharing reform of the European Stability Mechanism. Annals of Operations Research, J. No. 10479; Article No. 3325, (2019).

- A revised European Stability Mechanism to realize risk sharing on public debts at market conditions and realign economic cycles in the Euro area. Economic Notes, vol. 3, ISSN: 0391-5026, (2018).

- ECB monetary expansions and euro area TARGET2 imbalances: a balance-of-payment based decomposition. European Journal of Economics and Economic Policies, ISSN: 2052-7764, (2018).

- ECB’s euro-exit redenomination hedge. RISK, ISSN: 0952-8776, (2017).

- Fed data dependency backfires. RISK, ISSN: 0952-8776, (2016).

- The European Debt Refinincing Program. Rivista di Politica Economica, ISSN: 0035-6468, (2015).

- Why Europe’s QE resembles a CDS trade. RISK, ISSN: 0952-8776, (2015).

- Control the spread. RISK, ISSN: 0952-8776, (2014).

- Curing the Eurozone. RISK, ISSN: 0952-8776, (2013).

- A revisited and stable Fourier transform method for affine jump diffusion models. Journal of Banking & Finance, ISSN: 0378-4266, (2013).

- Detecting Market Abuse. RISK, ISSN: 0952-8776, (2004).

- Insider trading, abnormal return and preferential information: Supervising through a probabilistic model. Journal of Banking & Finance, ISSN: 0378-4266, (2003).

- Inside insider trading. RISK, ISSN: 0952-8776, (2002).

- The Primary Market of Structured Bonds. Rivista di Politica Economica, ISSN: 0035-6468, (2001).

HONOURS

In 2022:

- he receives the Medaglia di Rappresentanza della Repubblica for the Metamorfosi Project: the wood of the boats abandoned by migrants on the Italian coasts is recycled by the inmates of prison houses to make goods, including string instruments that make up the “Orchestra del Mare“;

- he receives the Benemerenza Speciale of the Nobile Accademia Internazionale Mauriziana;

- he was awarded the title of Knight Officer of Merit of Sacred Military Constantinian Order of Saint George.

In 2020 he was appointed Ufficiale della Repubblica, after his appointment in 2009 as Cavaliere della Repubblica.

ACADEMIA

1999-present | lectures on economic and financial topics at various Italian and foreign universities and specialized structured finance courses for practitioners

In the period 2019-2020 he held the course “The Eurozone Risk Morphology” aimed at PhD students at the Sant’Anna Institute in Pisa and Université Côte d’Azur in Nice.

In the period 2006-2020 he held the course “Topics in Quantitative Finance” aimed at Master students at the Bocconi University.

In the period 2015-2020 he held the course “Advanced derivative pricing and calibration via quadrature” at London Graduate School of Mathematical Finance, a joint venture between the mathematical finance groups at the main universities in London.

In 2018 he obtained the National Scientific Habilitation Qualification as Associate Professor in Economics of Financial Intermediaries and Corporate Finance and in Economic Policy and in Mathematical Methods for Economics and for Actuarial and Financial Sciences.

Since 2021 he has been qualified as a Full Professor in Economics of Financial Intermediaries and Corporate Finance and as Associate Professor in Economic Policy.

EDUCATION

- 1997-2001 | Università di Brescia

Ph.D in Mathematical Finance. - 1998-1999 | Columbia University, New York

Master of Arts in Mathematical Finance. - 1998 | Qualification

Chartered Accountant (“Revisore dei conti”). - 1994 | Qualification

Chartered Tax Advisor Accountant (“Dottore commercialista”). - 1994-1995 | Italian Navy

Cadet Officer (Naval Academy and Guard of Honor). - 1989-1993 | Università Bocconi

Degree in Economics (Summa cum laude); Mr. Mario Monti awarded him the gold medal as the youngest graduate of his course.

INSTITUTIONAL ASSIGNMENTS

EXCISE CUSTOMS AND STATE MONOPOLIES AGENCY (ADM) [2020-2023]

During his tenure as Director General he profoundly reorganized the Agency which, under his leadership, plays a strategic role during the Brexit, the pandemic crisis, the energy crisis and the Russian-Ukrainian conflict.

The results are measurable and illustrated through new publications: the Libro Blu and the Quarterly Statistical Bulletin presented at the Trento Economics Festival.

The Agency, through a series of regulatory, inspection and information supervisory interventions, brought tax revenues to the public purse of 80 billion euros in 2022, sharply up compared to around 60 in 2020. The results achived include:

- the recovery of almost 2 billion euros in the fight against fuel fraud;

- the closure of more than 150 illegal petrol stations;

- the 100-fold increase in drug seizures in ports;

- the 1000-fold increase in waste seizures in customs areas;

- the 3-fold increase in seizures of counterfeit goods;

- the seizure of over 150 million euros fo currency crimes in connections with passenger traffic;

- the shutdown of over 2,500 websites the 10-fold increase in interdictory interventions on e-commerce platforms;

- a series of interventions on supply chiains that have reduced smuggling of tobacco and inhaled liquids by 80%;

- the creation of the new supervised distribution network for inhaled liquids;

- the disposal of over 20 tons of seized tobacco;

- the disposal of over 300 clandestine gambling dens and the imposition of fines of over 10 million euro;

- the start of upgrading of the scanner network in ports and airports which also includes innovative portable instruments;

- the modernization of procedures for managing seized assets, which made it possible to make dozens of cars (that otherwise would not have been possible to register), thousands of liters of fuel and goods of various kinds available to other State Administrations and to lauch innovative online auction procedures which made it possible to dispose of dozens of luxury goods, cars and boats that have been previously seized to the underworld;

- the start of ports’ digitization with the use of remote surveillance;

- the start ot the so called Lotteria degli scontrini, the free lottery connected to the Italy Cashless Program, developed by the Government to encourage the use of credit cards, debit cards, prepaid cards, cards and apps connected to private payment circuits with limited spendability, in order to modernize the Country and to promote the development of a more digital, faster, simpler and transparent system.

In the 2020-2023 period, ADM also digitized and modernized processes, becoming a partner for the development of Italian businesses. In particular, the following should be noted:

- the “zero kilometer customs” project which brought customs controls to the offices of over 5,000 companies;

- the activation of geo-location systems to create remotely supervised customs fast corridors including the longest railway fast corridor in Europe which connects Gioia Tauro to Bologna;

- the Single System of Customs Controls S.U.Do.Co. to simplify, speed up and make transparent the procedures for checking goods entering and leaving Italy and increase the competitiveness of the national logistics network in ports and airports;

- the disposal of more than 3,000 “sea wrecks” stranded on the coast or semi-sunken in the ports (of which a dozen of tonnage exceeding 100 tons);

- the “houses of legality”, where counterfeit goods are exhibited, even in comparison with the original ones, in the main ADM offices, trade fairs, squares of Italian cities, as well as in airports and ports;

- the new supervisory procedures to protect “Made in Italy” and to counter the Italian sounding by making the certifications of chemical laboratories available to the national production system through the in-house company ADM-Qualitalia SpA;

- the reactivation, after years of inertia, of the Customs Free Zones.

ADM also defined new procedures for carrying out competitions for officials and managers on an annual basis after more than ten years of inaction; in just over six months, over 1,000 officials and assistants were selected from over 175,000 candidates with a full digital procedure at 14 national exhibition centers.

As part of the First Sector, the Agency is a regulatory and supervisory authority over 350,000 subjects (I.E., the Second Sector) launched a series of projects to establish a strong link with the Third Sector on topics like disabilities, workplace discrimination, and social policies.

«Dimensione Sociale» is an initiative created to realize a link between the second and third sector. ADM launched an Open Call to address many social emergencies and received funds by its institutional partners. The following associations participated in the project: the Sant’Egidio community, the “Bambini delle Fate” and the “Lega Filo d’Oro” non-profit organizations, and the Italian Red Cross. For these initiatives, ADM was able to collect more than 500,000 euros during the year 2022.

Another initiative carried out by ADM is «Disegniamo la Fortuna», a national competition dedicated to artists with disabilities. The artworks submitted were evaluated by an exceptional jury (Gianni Letta, Renzo Arbore, Claudio Baglioni, Cesare Bocci, Stefano Boeri, Milly Carlucci, Cristiana Collu, Pierfrancesco Favino, Pino Maddaloni, Giulio Rapetti Mogol, Patrizia Sandretto Re Rebaudengo, Vincenzo Salemme, Marco Tardelli, and Carlo Verdone). The winning artworks were printed on the National Lottery’s tickets.

«Metamorfosi» is a social inclusion project, realized in collaboration with the “Casa dello Spirito e delle Arti” and the Italian Department of Corrections. Thanks to the “Metamorfosi” project, the scrap wood collected from the ships used by migrants – ships that were recovered and disposed of by the ADM – was made available to the Milano Opera Prison after being released by the Judicial Authority. Inmates of this Correctional Institution used this wood to craft unique musical instruments, a symbol of redemption and rebirth. Among these instruments, a violin has been blessed by the Holy Father. The instruments are played by the «Orchestra del Mare» (The Sea Orchestra). Nicola Piovani composed a symphony titled «Canto del Legno» (The Wood Song) for the Orchestra del Mare. The “Metamorfosi” project has been awarded the Medal of Representation of the President of the Republic in recognition of the high social value of the initiative. The initiative has also been documented in a short film, which has been presented at the 79th Venice International Film Festival and the Rome Film Festival.

COMMISSIONE NAZIONALE PER LE SOCIETÀ E LA BORSA (CONSOB) [1996-2020]

Quantitative analyses and integrated systems are introduced into the supervisory and regulatory activities as key features of quant enforcement and quant regulation.

The Early Years

Having passed a national exam, he joins the Enforcement Unit.

Chairman Mr. Tommaso Padoa-Schioppa involves him in ad hoc working groups established at the Treasury, then headed by Minister Mr. Carlo Azeglio Ciampi and Director General Mr. Mario Draghi.

The “Quant Surveillance”, the Regtech and Investors’ Education

After having returned from Columbia University, at the request of the newly-appointed Chairman Mr. Luigi Spaventa, he elaborates quantitative analyses to support Consob’s enforcement action, also in cooperation with other European and U.S. regulators.

He develops in-house the Integrated Systems, such as SAIViM, that, via big data analysis, generate tripwires enabling to support an objective supervisory activity.

He resorts to artificial intelligence to articulate a web spidering procedure that detects internet financial frauds, resulting in hundreds of websites being shut down pursuant to D. Lgs. No. 70/2003.

In that period, he is involved in developing and launching investor education tools, such as videos, illustrating in layman’s language structured financial products and offering sample calculators enabling to determine the related risks.

He continues his research in Mathematical Finance and publishes his first book, A Guide To Quantitative Finance.

The 3-Pillar Supervisory Approach

Consob’s supervision is extended to the risk transparency analysis of bank-assurance products.

In 2007 he is appointed Head of the Quantitative Analysis Unit.

In 2009 the 3-pillar supervisory approach is enshrined into the Italian regulations. This approach is based on a set of synthetic probability indicators enabling to identify for each non-equity product the minimum investment time horizon, its risk degree and potential returns.

Such metrics are illustrated in another book, A Quantitative Framework to Assess the Risk-Return Profile of Non-Equity Products, presented at several universities, including the Scuola Normale of Pisa, featuring Professor Hélyette Geman as co-discussant.

ROMA CAPITALE [2015-2016]

He follows the economic-financial issues alongside the Extraordinary Commissioner Francesco Paolo Tronca. He continues as Technical Assessor in the new Council.

A series of activities are launched to put the accounts in order:

- the “Affittopoli” investigation to verify the regularity of the rentals and restore income to the huge real estate assets of Roma Capitale;

- the redefinition of the Debt Repayment Plan by receiving the authorization from the competent government structures;

- the restart of relations with the Commissioner’s Debt Management of the former Municipality of Rome, also in relation to the risks of pre-existing positions in derivatives;

- the “dormant accounting items” project which allows for a “cleansing” of the Roma Capitale balance sheet, recovering € 70 million for new investments.

These activities make it possible to acquire spending space for € 230 million to cover off-balance sheet debts and to carry out an extraordinary Budget Adjustment in July in which it is possible to close with a positive public finance balance of € 1.6 million.

In terms of subsidiaries, the top management of AMA and ATAC are reviewed and leaner organizational structures are defined with a unique executive officer in order to implement the super-utility project in synergy with ACEA which unfortunately will remain on paper.

The AMA collection system was redesigned to rationalize above all the management of credit recovery and a due diligence was launched on the company’s derivatives operations.

The rationalization of the balance sheet items allows for investments of almost 20 million euros for the subway A and the definition of a new contract for the cleaning of trains and public transport.

The industrial plan is redefined on ATAC, also providing for a valorisation in project financing of the real estate assets, managing to recover new financial resources for € 50 million. The “Rome City” project is launched to create a ticket verification system similar to the London one and recover the significant fare evasion of public transport free riders.

The Assessoril structure also manages to enhance the potential of ACEA by obtaining the positive feedback from the markets as recorded by the stock market prices:

- avoid the water tariff increase with a redefinition of the structure by maturity of the financial flows;

- starts the modernization of the lighting networks with the installation of LEDs and remote control systems;

- designs an innovative maintenance of water and electricity networks capable of combining network management with road maintenance and fiber optic cabling for telemetry/control activities;

- hypothesizes innovative waste management in synergy with AMA and with the blast furnaces of the steelworks.

On the occasion of the earthquake in central Italy, the Assessoril structure managed to make more than 50 vehicles from AMA, ACEA, ATAC and Rome Capital available to the civil protection, as well as apartments for the earthquake victims.

In terms of housing policies, a survey of illegally occupied buildings was launched and a timetable for evictions was launched, defining a new discipline for the assignment of housing to needy families in coordination with the Region and in synergy with the National Agency for Confiscated Assets.

A redefinition of the Credit Management policy is being carried out also through the absorption of the functions of Equitalia and an integrated management of the various open positions with the Lazio Region; a survey of the uncollected receivables of Roma Capitale and of the subsidiaries is launched in order to define a new management model capable of recovering €100 million.